After a muted 2024, many are assuming Summer 2025 will follow suit—with low volatility and limited upside. Forward prices are flat, battery revenues are compressed, and ERCOT’s load forecast looks unremarkable. On the surface, it resembles a repeat of 2024.

We see a different picture. We believe summer volatility is being underestimated and that the coming months will likely be more profitable for battery operators than market signals suggest.

The backdrop: Volatility is compressing into fewer, sharper events. According to the recent 2024 ERCOT State of the Market report, 80% of last summer’s price spikes occurred in just 22 hours. That concentration reflects a system where stress appears abruptly rather than building gradually. Operators who miss those few hours miss the bulk of the opportunity.

Prediction #1: The sunset ramp will create one of ERCOT’s biggest structural risks

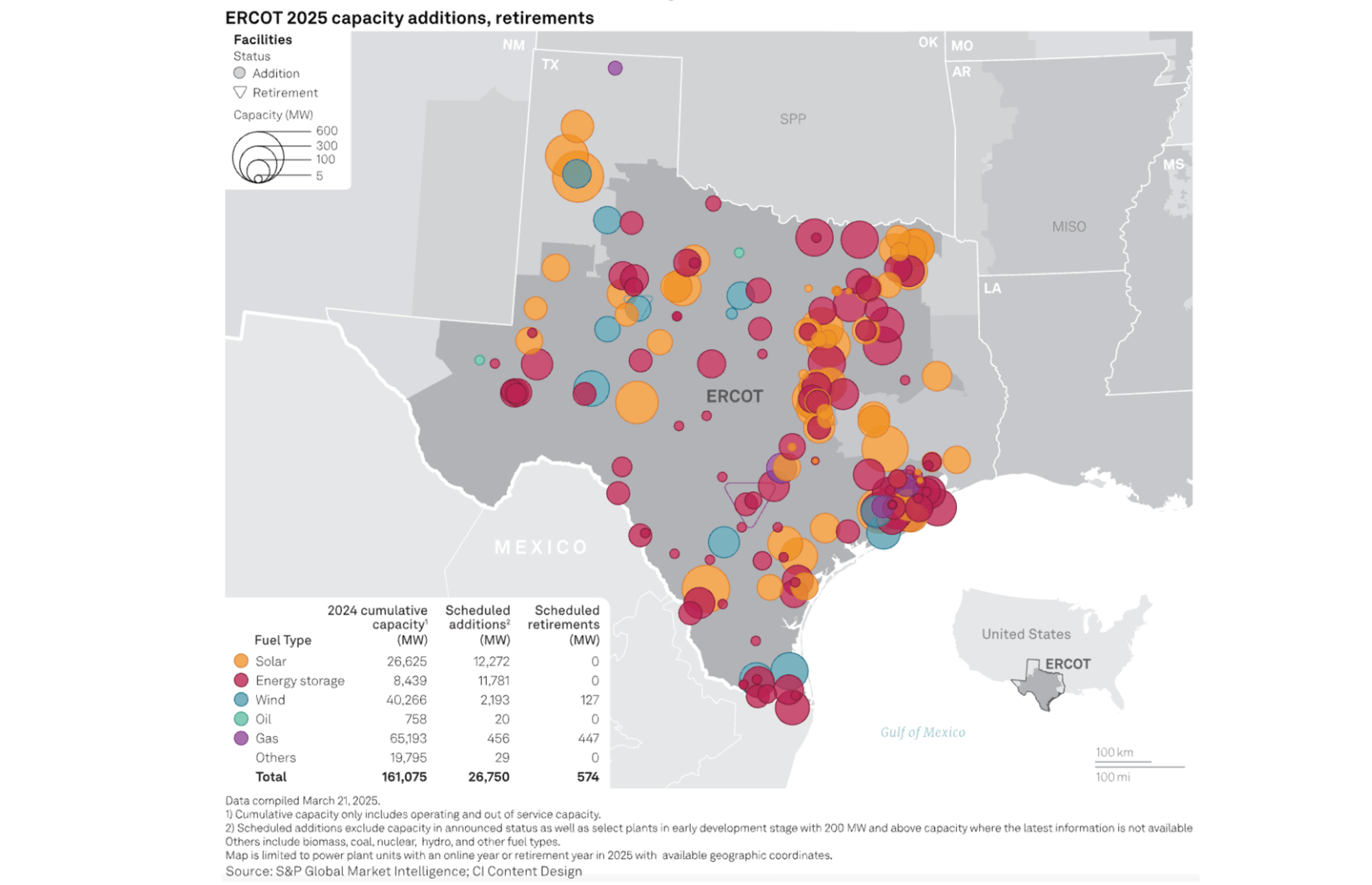

Solar has doubled its share of ERCOT’s fuel mix since 2022, and each evening, 15 to 26 GW of solar generation drops off the grid within a few hours. That’s more than the peak load of some regional systems, disappearing right as the grid enters its most vulnerable state.

To fill the gap, ERCOT depends on aging thermal plants—dozens of aging gas and coal units expected to ramp in near lockstep. These plants weren’t designed for daily, synchronized starts and are increasingly prone to failure. With heavy reliance on aging conventional assets, scarcity conditions can emerge quickly.

This is a daily structural vulnerability. Batteries can play a role in stabilizing the handoff, but only if they’re positioned well and ready to act with precision.

Prediction #2: Multiple hours above $4,000/MWh are probable in Q3

Forward curves may be calm, but that calm masks fragility. ERCOT doesn’t need record-setting heat to see scarcity pricing. A modest forecast error—whether in load or renewable output—combined with tighter reserves or a thermal unit trip during the evening ramp, could be enough to send prices spiking.

Based on current risk conditions, we expect multiple hours above $4,000/MWh in Q3. These events may not be visible in forward forecasts, but they will determine who captures the upside.

Prediction #3: Batteries could still beat $200k/MW-year

Despite ancillary services saturating, the energy arbitrage opportunity—where batteries buy and sell wholesale power—still has significant potential, especially during unexpected price spikes. For reliable batteries with strong optimization strategies, earnings potential is high for Summer 2025. We see a possible path for top-performing batteries to earn over $200,000 per MW this year.

Success here depends on execution. That means bidding strategies that anticipate volatility, rapid response to real-time signals, and the operational discipline to stay nimble. This won’t be a broad market recovery across all battery assets. It will be a sharp separation between average and exceptional operators.

So what? Six actions battery operators should take now

The takeaway for battery operators shouldn’t be binary optimism or pessimism. It’s readiness. Operators should:

- Run scenario tests that combine ramp-down stress with common thermal outage patterns

- Line up hedges that match your fleet’s local risk profile and temporal flexibility

- Refine bid curves to capture sharp pricing moves, not just daily averages

- Shift exposure away from over-saturated ancillary markets toward targeted energy events

- Tighten operational workflows to empower fast, informed decisions

- Make sure batteries physical performance and reliability is maximized to reduce DA/RT exposure risk and SASM risk

You can’t run a battery fleet on autopilot. The winners will combine data, intuition, and game theory. One hour of chaos can define a month of returns, and that’s the math battery operators need to focus on.

Final take: ERCOT is a market shaped by rare but dramatic events. Volatility hasn’t vanished. It has changed form. For operators that anticipate that shift and prepare accordingly, Summer 2025 is a strong opportunity.

By Michael Kirschner, U.S. Managing Director

Habitat Energy is one of the largest optimizers of battery storage in ERCOT. For technical insights or to discuss fleet strategy, reach out to Adam Krivisky at adam.krivisky@habitat.energy.